To learn the technique of Warren-buffett follow the link below:

Thursday, December 14, 2017

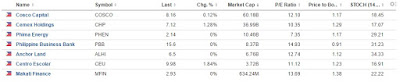

Philippine Stocks Watch-list : DEC 2017 :: SALE!!!

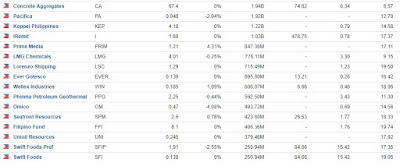

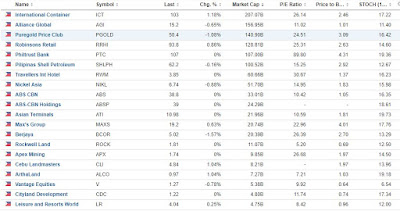

Philippine Stocks Watch-list that are currently undervalued for the month of December:

Wednesday, November 22, 2017

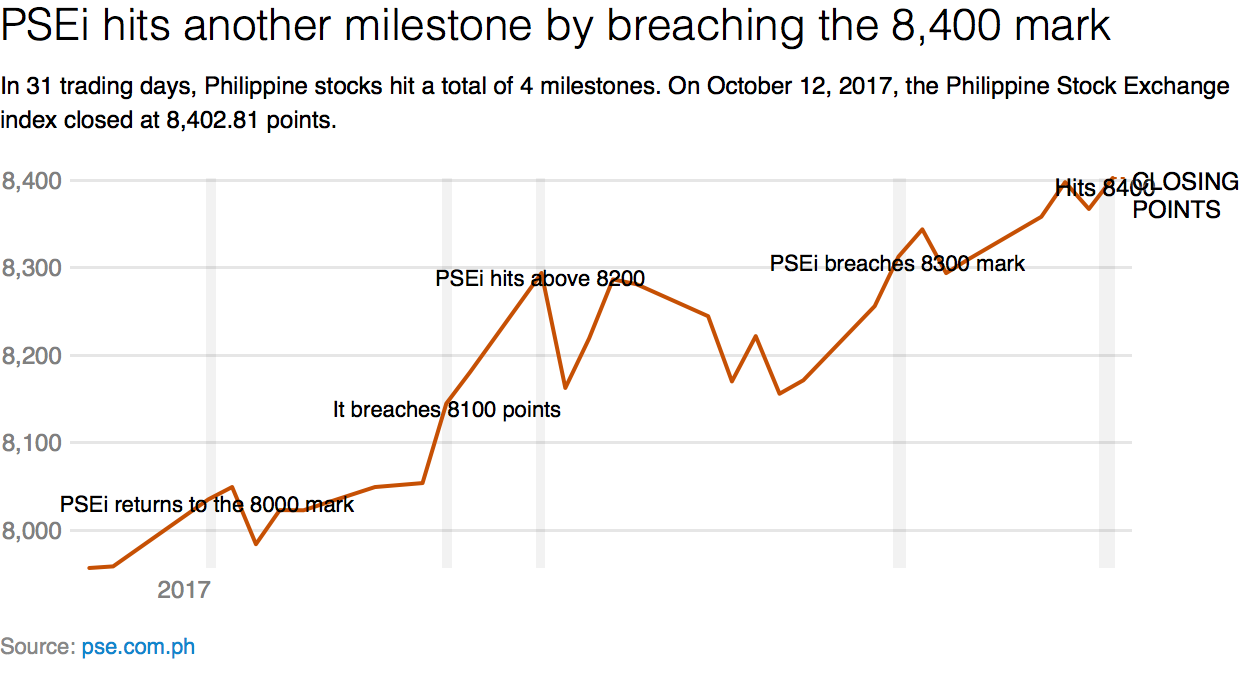

Philippine stocks close above 8,400 in new milestone

MANILA, Philippines – Philippine stocks continued their rally, breaching the 8,400 mark on Thursday, October 12, as investors took their cue from sentiments overseas.

At the close of Thursday's trading, the Philippine Stock Exchange index (PSEi) surged by 0.53% to 8,402.81 points. Meanwhile, the broader All Shares index rose by 20.40 points or 0.42% to 4,928.28 at the closing bell.

This is the PSEi's 4th milestone in 31 trading days.

On the same day, Bloomberg reported that Asian equities advanced after US stocks hit record highs.

Bloomberg also reported that minutes from the US Federal Open Market Committee (FOMC) meeting in September show that a December interest rate hike is likely.

"Philippine markets resumed the upward trajectory as the minutes from the FOMC meeting cofirmed what was on many analysts' minds," Marita Limlingan, president of Regina Capital Development Corporation, said in a note. (READ: New milestone as Philippine stocks breach 8,300 mark)

"The minutes from the September FOMC meeting discussed near-term effects from hurricanes Harvey, Irma, and Maria; but suggested broadly unchanged views on the underlying pace of growth and inflation," she added.

On the local front, the Philippine market is zeroing in on the developments in the proposed Tax Reform for Acceleration and Inclusion (TRAIN) bill.

President Rodrigo Duterte's economic managers said they are trying to convince the Senate to make its version of tax reform "closer" to that of the House of Representatives, to get enough financial muscle needed to implement the country's ambitious infrastructure program.

Socioeconomic Planning Secretary Ernesto Pernia had said he is optimistic that implementation of the tax reform package can begin by January 2018. (READ: EXPLAINER: Senate, House versions of the tax reform bill)

Read more: https://www.rappler.com/business/185090-philippine-stock-exchange-index-close-above-8400

Tuesday, November 14, 2017

Philippine Stocks Watch-list : NOV 2017

Philippine Stocks Watch-list that are currently undervalued for the month of November:

To learn the technique of Warren-buffett follow the link below:

Thursday, October 26, 2017

Philippine Stocks Watch-list : OCT 2017

Philippine Stocks Watch-list that are currently undervalued for the month of October:

To learn the technique of Warren-buffett follow the link below:

Wednesday, September 27, 2017

The Secret Behind a Property Company's 2,500% Stock Surge

It’s been a fast ascent for college dropout Edgar “Injap” Sia, who less than a decade ago was selling barbecue chicken in the Philippines. He now leads the real estate developer with the best stock gains in Asia.

His company, DoubleDragon Properties Corp., went public in the Philippines in 2014 and has surged 2,500 percent since it began trading in April that year through Jan. 31, beating 460 other Asian developers worth at least $500 million. That surge has inflated DoubleDragon’s market value to 115.1 billion pesos ($2.3 billion), propelling it to the nation’s top five developers even though it owns and manages a fraction of the real estate held by its rivals.

Sia was studying architecture when he dropped out at 19 to start a business venture with classmates. Now 40, Sia ranks among the youngest tycoons in the Philippines. In 2003, he started a chicken shop in Iloilo City before turning it into a nationwide chain that overtook McDonald’s Corp. in store count in 2010. That year, he sold his Mang Inasal chicken chain to Jollibee Foods Corp., and later partnered with its founder Tony Tan Caktiong and with SM Investments Corp., owner of the nation’s largest retailer, to venture into property and malls.

With the same lofty ambitions he used to expand his chicken empire, Sia aims to operate 100 CityMall outlets by 2020 to help meet the basic needs of shoppers in smaller provinces. DoubleDragon is a minnow among Asian developers -- it had $844.5 million of assets in the third quarter of 2016, about 0.6 percent of the assets of Asia’s largest real estate company, China Evergrande Group.

“The stock has outperformed because many investors believe in its business model, which is geared towards addressing geographical gaps in retail,” said Cristina Ulang, head of research at Manila-based First Metro Investment Corp. “DoubleDragon is very focused on penetrating smaller cities that are growth areas of the future. It’s already positioned ahead of the others when growth filters into these smaller cities. ”

Since DoubleDragon’s 2014 initial public offering, the only developers worldwide to beat its gain have been a Venezuelan real estate investment trust and a U.S.-listed Chinese provider of real estate services. The stock surge inflated DoubleDragon’s market value to a record in June that then made it the third-most valuable Philippine builder, dislodging Megaworld Corp., the largest landlord for call centers. While DoubleDragon shares are down 26 percent from their all-time high, the stock may rebound to a new record if the company delivers on mall roll-out and earnings growth pledges, Ulang said.

The stock rose as much as 5.6 percent to a three-month high, outpacing a 0.2 percent gain in the benchmark Philippine Stock Exchange Index.

Monday, September 25, 2017

Philippine Stocks Watch-list : SEPT 2017 : SALE!!!

Philippine Stocks Watch-list that are currently on SALE for the month of September:

To learn the technique of Warren-buffett follow the link below:

Thursday, September 14, 2017

PSEi Breakout

PSEi Breakout @ 8,137, PSEi is now at 8,144.9 Points and may peak this year at 8,400 to 8,800 Points.

Tuesday, August 22, 2017

Investagrams' Guide on How To Start Investing In the Stock Market

All you need to know before you embark on your journey

Ano ba ang Stock Market?

Ano ba ang Stock Market?

Ito ang mga karaniwang tanong na nakukuhanamin:

"Sir paano po ba yang i-stock market?" "Hi Sir, I'm interested in the Stock Market, paano po ba mag-simula?" "Bro, paano ba kumikita diyan sa stocks? Parang ayos yan ah" "Ser, single ka ba?"

Ngayon sasagutin namin ang lahat ng inyong mga katanungan.

Back to basics tayo.

i-discuss muna natin kung paano gumagana ang isang market

Ano ang pinaka simpleng example ng isang market?

Palengke.

Sa palengke ang mga binibili at binebenta ay mga gulay, prutas, bigas, at iba pang mga kasangkapan natin sa pang-araw-araw.

Ang stock market ay para ring Palengke.

Pero imbes na mga produkto, sa stock market ang nabibili mo ay mga COMPANY.

Oo tama, mga Kumpanya.

Mga kumpanya na nag bibigay satin ng produkto at serbisyo sa pang-araw araw nating pamumuhay, gaya ng Ayala Land, Meralco, PLDT, Megaworld, Petron, San Miguel, Jolibee atbp.

Philippine Stocks Watch-list : AUG 2017 : SALE!!!

Philippine Stocks Watch-list that are currently on SALE for the month of August:

To learn the technique of Warren-buffett follow the link below:

Monday, August 7, 2017

Col Financial @ Cebu

Good news to Cebuanos Col Financial is now in Cebu, Investors may visit their office and inquire about investing in stocks and mutual funds, and for help in navigating the COL website.

Address:

| Unit B205 Axis Entertainment Ave. Vibo Place, N. Escario St. Barangay Camputhaw, Cebu City |

Telephone:

| (+6332) 261-8601 (+6332) 261-8615 (+6332) 261-8624 |

Email:

| colcebu@colfinancial.com |

Thursday, August 3, 2017

COL Financial MID-YEAR Marketing Briefing

Date:

|

August 12, 2017 (Saturday)

|

Time:

|

9:00 AM to 12:00 NN

Registration starts at 8:00 AM

|

Venue:

|

Meralco Theater

Ortigas Avenue, Pasig City

|

To register follow the link below:

https://events.r20.constantcontact.com/register/eventReg?oeidk=a07eefe9plv1e99900b&oseq=&c=&ch=

Note:

Please ensure to print your e-ticket for faster registration at the event.

Monday, July 24, 2017

Philippine Stocks Watch-list : JULY 2017

Philippine Stocks Watch-list using Warren-buffett stocks filter applied to PSE

To learn the technique of Warren-buffett follow the link below:

Tuesday, July 4, 2017

Waive deposit charges when funding your COL account.

Philippine Stocks - Col Financial has successfully negotiated with BDO and BPI to waive certain deposit charges when funding your COL account.

The new bank fees for the use of the deposit facilities of BDO and BPI effective July 1, 2017 are summarized below:

Friday, June 9, 2017

Philippine Stocks Watch-list : JUNE 2017

Philippine Stocks Watch-list using Warren-buffett stocks filter applied to PSE

To learn the technique of Warren-buffett follow the link below:

Monday, May 22, 2017

Trade and earn in the Philippine stocks market using this App

Tsupetot - from the word tsup (means kiss or love) and petot (means peso or earn). Love and Earn (nagmahal at kumita in tagalog). Tsupetot is the app that will help you love to trade and earn in the Philippine stocks market.

Whether you are a local from Philippine or a foreign investor, this is the tool for you to easily view real-time Philippine stocks latest market values and historical charts with standard indicators like MACD, RSI, MFI, SMA20 and EMA13.

List of Features include:

1. Sortable Page by %Change, Volume, and Price

2. Last 3 candle view

3. View all stocks chart profile in single page

4. Market Status

5. Stocks Historical Data with indicator

6. PSEi and Sectors Historical Data with indicator

7. Create Porfolio

8. Create Cheatlist/Watchlist

Download now @ Google Play

https://play.google.com/store/apps/details?id=com.flankzone.Tsupetot&hl=en

Download now @ iTunes

https://itunes.apple.com/ph/app/tsupetot/id1161242831?mt=8

Monday, May 15, 2017

Philippine Stocks Watch-list : MAY 2017

Philippine Stocks Watch-list using Warren-buffett stocks filter applied to PSE

To learn the technique of Warren-buffett follow the link below:

Monday, April 10, 2017

Philippine Stocks Watch-list : APR 2017

Philippine Stocks Watch-list using Warren-buffett stocks filter applied to PSE

To learn the technique of Warren-buffett follow the link below:

Friday, March 24, 2017

Pure Energy’s P1.6B IPO ok’d

The Securities and Exchange Commission (SEC) has approved a plan by Pure Energy Holdings Corp. to raise as much as P1.6 billion from an initial public offering.

Pure Energy plans to sell 930 million primary shares at a maximum price of P1.62 per share. Some 46.5 million in secondary shares have been earmarked as overallotment option.

The offering will bring to public hands up to 15.6 percent of its total shares post-IPO.

Bulk of the proceeds will be used by Pure Energy as capital for hydropower projects. The rest will be used for joint venture projects as well as operating and working capital.

Pure Energy is led by Dexter Tiu, its chair and chief executive officer. Tiu is also a director and treasurer of Coal Asia Holdings.

The company was incorporated in 2013 as a holding firm. Its three subsidiaries are REDC, Pure Water and Pure Geothermal.

REDC is into renewable energy while Pure Water has interests in bulk water, distribution utility and underwater treatment service provider.

REDC won the bidding for a geothermal concession area called Southern Leyte Geothermal Project, located at the south of the renowned Tongonan Geothermal Field. Initial feasibility study conducted by Japan External Trade Organization had estimated an available capacity of 110 megawatts.

Read more: http://business.inquirer.net/226712/pure-energys-p1-6b-ipo-okd

Pure Energy plans to sell 930 million primary shares at a maximum price of P1.62 per share. Some 46.5 million in secondary shares have been earmarked as overallotment option.

The offering will bring to public hands up to 15.6 percent of its total shares post-IPO.

Bulk of the proceeds will be used by Pure Energy as capital for hydropower projects. The rest will be used for joint venture projects as well as operating and working capital.

Pure Energy is led by Dexter Tiu, its chair and chief executive officer. Tiu is also a director and treasurer of Coal Asia Holdings.

The company was incorporated in 2013 as a holding firm. Its three subsidiaries are REDC, Pure Water and Pure Geothermal.

REDC is into renewable energy while Pure Water has interests in bulk water, distribution utility and underwater treatment service provider.

REDC won the bidding for a geothermal concession area called Southern Leyte Geothermal Project, located at the south of the renowned Tongonan Geothermal Field. Initial feasibility study conducted by Japan External Trade Organization had estimated an available capacity of 110 megawatts.

Read more: http://business.inquirer.net/226712/pure-energys-p1-6b-ipo-okd

Sunday, March 19, 2017

PSEi soars past 7,300 as US Fed jitters fizzle out

The stock barometer surged to the 7,300 level on Friday as the US Federal Reserve’s less hawkish stance boosted risk-taking appetite.

Rising for the second straight session on Friday, the Philippine Stock Exchange index (PSEi) gained 66.42 points or 0.91 percent to close at 7,345.02. The local index outperformed regional markets.

For the week, the PSEi racked up 198.75 points or 2.8 percent.

“Risk-love is in euphoria, expectations elevated, and economic surprises at peak,” investment house BofA Merrill Lynch said in a research note.

While the US Federal Reserve recently hiked interest rates by 25 basis points, its subsequent statements quashed earlier fears of a faster pace of tightening moving forward.

On Friday, the day’s gains were led by the cyclical financial and property counters, which both advanced by over

1 percent.

Only the industrial counter ended lower.

Value turnover for the day amounted to nearly P14 billion. Foreign investors were in a net buying position amounting to P169 million.

There were 103 advancers that beat 78 decliners, while 58 stocks were unchanged.

JG Summit led the PSEi higher with its 4.18 percent gain, while BPI and RLC both added over 3 percent.

EDC gained over 2 percent while ALI, BDO, SM Investments and ICTSI all rose by over 1 percent.

SM Prime, Ayala Corp., PLDT and Security Bank all firmed up.

Meanwhile, Metro Pacific, URC and AEV all tumbled by over 2 percent.

DMCI, GT Capital and Jollibee all slipped by over 1 percent.

Cemex continued to slide yesterday by 3.23 percent.

Read more: http://business.inquirer.net/226332/psei-soars-past-7300-us-fed-jitters-fizzle

Wilcon to raise P7B in Philippines’ 1st IPO this year

WILCON Depot, Inc. is raising P7 billion in the first initial public offering (IPO) this year after pricing the deal at the low end of its target range.

In a statement released on Friday, First Metro Investment Corp. (FMIC) Executive Vice-President Justino Juan R. Ocampo said the IPO price of the home improvement and construction supplies retailer was set at P5.05 per share, giving the company a market capitalization of more than P20 billion after listing.

“We convinced Mr. Belo to price at lower end to ensure discount to comparables and give upside to investors,” BDO Capital & Investment Corp. President Eduardo V. Francisco said in a separate mobile phone message, referring to Wilcon Chairman William T. Belo.

Wilson had earlier set a price range of P5-P5.68 apiece.

The offering was more than three times oversubscribed on the back of strong demand from “quality” institutional investors and offshore investors attracted to the strong prospects of the country’s construction and housing industry, FMIC said.

“The success of Wilcon’s IPO demonstrates the investment community’s continued confidence in the Philippine retail market. As disposable income of Filipinos increases, a lot more people are now buying houses or improving their existing homes,” Mr. Belo said in the same statement.

Proceeds from the IPO will be used to bankroll store network expansion, debt retirement and general corporate purposes, according to Wilcon’s prospectus.

Since opening its first store in 1977, Wilcon has transformed itself into a one-stop shop for construction supply and home improvement. It has 37 depots and small format stores across the country, 17 of which are in Metro Manila, 16 more in Luzon, 2 in Visayas, and 2 in Mindanao, with over 2,000 employees.

Wilcon is banking on the continued expansion of its store network to sustain double-digit growth in sales and earnings. In the first nine months of 2016, it booked a 10% year-on-year increase in net sales to P11.73 billion and netted 50% more or P483 million.

Wilcon kicks off the domestic tranche of the maiden share sale on March 20, with its debut on the Main Board of the Philippine Stock Exchange slated on March 31. The equity offer is selling 34% of its outstanding capital to the public.

FMIC was tapped as the issue manager and bookrunner, with BDO Capital also acting as joint lead underwriter for the IPO. RCBC Capital Corp. and Penta Capital Investment Corp. were mandated as co-lead underwriter and participating underwriter.

Read more: http://www.bworldonline.com/content.php?section=TopStory&title=wilcon-to-raise-p7b-in-philippines-1supstsup-ipo-this-year&id=142376

“We convinced Mr. Belo to price at lower end to ensure discount to comparables and give upside to investors,” BDO Capital & Investment Corp. President Eduardo V. Francisco said in a separate mobile phone message, referring to Wilcon Chairman William T. Belo.

Wilson had earlier set a price range of P5-P5.68 apiece.

The offering was more than three times oversubscribed on the back of strong demand from “quality” institutional investors and offshore investors attracted to the strong prospects of the country’s construction and housing industry, FMIC said.

“The success of Wilcon’s IPO demonstrates the investment community’s continued confidence in the Philippine retail market. As disposable income of Filipinos increases, a lot more people are now buying houses or improving their existing homes,” Mr. Belo said in the same statement.

Proceeds from the IPO will be used to bankroll store network expansion, debt retirement and general corporate purposes, according to Wilcon’s prospectus.

Since opening its first store in 1977, Wilcon has transformed itself into a one-stop shop for construction supply and home improvement. It has 37 depots and small format stores across the country, 17 of which are in Metro Manila, 16 more in Luzon, 2 in Visayas, and 2 in Mindanao, with over 2,000 employees.

Wilcon is banking on the continued expansion of its store network to sustain double-digit growth in sales and earnings. In the first nine months of 2016, it booked a 10% year-on-year increase in net sales to P11.73 billion and netted 50% more or P483 million.

Wilcon kicks off the domestic tranche of the maiden share sale on March 20, with its debut on the Main Board of the Philippine Stock Exchange slated on March 31. The equity offer is selling 34% of its outstanding capital to the public.

FMIC was tapped as the issue manager and bookrunner, with BDO Capital also acting as joint lead underwriter for the IPO. RCBC Capital Corp. and Penta Capital Investment Corp. were mandated as co-lead underwriter and participating underwriter.

Read more: http://www.bworldonline.com/content.php?section=TopStory&title=wilcon-to-raise-p7b-in-philippines-1supstsup-ipo-this-year&id=142376

Tuesday, March 14, 2017

PSEi holds fort ahead of influential Fed Meeting

The stock barometer continued to climb on Tuesday on selective buying of large cap stocks ahead of a much-awaited US Federal Reserve meeting.

The main-share Philippine Stock Exchange index (PSEi) added 28.66 points or 0.4 percent to close at 7,261.75, rising for the second session.

ADVERTISEMENT

“With no economic data Monday, investors were instead focusing on the two-day Federal Open Market Committee meeting that kicks off Tuesday,” said Luis Gerardo Limlingan, managing director at Regina Capital Development.

Limlingan noted that overnight, US stocks had closed marginally higher after switching between small gains and losses on Monday as investors refrained from making sizeable bets ahead of a Federal Reserve meeting that was widely expected to deliver an interest rate increase.

At the local market, the day’s gains were led by the financial, industrial, holding firm and services counters.

On the other hand, the mining/oil counter was down by 2.77 percent amid the challenging regulatory environment brought about by the government’s antimining bias.

Despite the PSEi’s slight gain, market breadth was negative. There were 105 decliners against 86 advancers, while 48 stocks were unchanged.

The PSEi was led higher by ICTSI, which surged by 5.04 percent and was the day’s most actively traded stock. ICTSI announced on Tuesday the opening of Puerto Aguadulce, a joint venture terminal in Port of Buenaventura, Colombia. The first phase of the $550-million world class multi-use container and bulk handling facility can handle mega container vessels with capacities of up to 18,000 TEUs (twenty-foot equivalent units).

On Monday, ICTSI also reported a 207-percent surge in net income to $180 million.

Read more: http://business.inquirer.net/226146/psei-holds-fort-ahead-influential-fed-meeting

Monday, March 13, 2017

PSEi back to 7,200 as SM rebounds

The local stock barometer climbed back to the 7,200 level on Monday as leading conglomerate SM Investments recouped most losses from Friday’s sell-off.

The main-share Philippine Stock Exchange index (PSEi) gained 86.82 points or 1.21 percent to close at 7,233.09 on the first day of the PSEi’s rebalancing.

All counters went up, led by holding firms, which firmed up by 1.9 percent due to SM’s rebound.

SM bounced by 7.76 percent to close at P645.50. To recall, SM slid by 9.24 percent last Friday as fund managers scrambled to realign their portfolios ahead of today’s main index rebalancing.

Effective today (Monday, March 13), SM’s weight (in PSEi) was reduced by 0.51 percent along with the removal of Emperador to accommodate the inclusion of Puregold with a 1-percent weight in the index. Ron Acoba, chief investment strategist at equities research provider Trading Edge, explained that the sharp drop seen on Friday was because index funds that track the PSEi appeared to be worth more than P100 billion which sold 0.5 percent of their SM shares at Friday’s closing.

When asked whether SM had bought back shares from the open market on Monday, SM investor relations chief Cora Guidote said the rebound by driven by bargain-hunting. “A lot of investors had been waiting for a buying window. Since the drop in shares last week was purely technical, investors took advantage,” Guidote said.

Apart from SM’s rebound, the upswing in the local market also reflected mostly firmer regional markets.

“After much market drama, another rate increase from the FOMC (Federal Open Market Committee) now looks like a forgone conclusion when the committee members meet later this week. This information is already being discounted into the market,” said Luis Gerardo Limlingan, managing director at Regina Capital Development.

In addition, Limlingan noted that US non-farm payrolls had increased by 235,000 in February with a 9,000 upward revision to the prior two months, moderately above consensus expectations. Meanwhile, he noted that US jobless ratio had edged down to 4.7 percent, one tenth below Fed officials’ estimate.

Read more: http://business.inquirer.net/226080/psei-back-7200-sm-rebounds

The main-share Philippine Stock Exchange index (PSEi) gained 86.82 points or 1.21 percent to close at 7,233.09 on the first day of the PSEi’s rebalancing.

All counters went up, led by holding firms, which firmed up by 1.9 percent due to SM’s rebound.

SM bounced by 7.76 percent to close at P645.50. To recall, SM slid by 9.24 percent last Friday as fund managers scrambled to realign their portfolios ahead of today’s main index rebalancing.

Effective today (Monday, March 13), SM’s weight (in PSEi) was reduced by 0.51 percent along with the removal of Emperador to accommodate the inclusion of Puregold with a 1-percent weight in the index. Ron Acoba, chief investment strategist at equities research provider Trading Edge, explained that the sharp drop seen on Friday was because index funds that track the PSEi appeared to be worth more than P100 billion which sold 0.5 percent of their SM shares at Friday’s closing.

When asked whether SM had bought back shares from the open market on Monday, SM investor relations chief Cora Guidote said the rebound by driven by bargain-hunting. “A lot of investors had been waiting for a buying window. Since the drop in shares last week was purely technical, investors took advantage,” Guidote said.

Apart from SM’s rebound, the upswing in the local market also reflected mostly firmer regional markets.

“After much market drama, another rate increase from the FOMC (Federal Open Market Committee) now looks like a forgone conclusion when the committee members meet later this week. This information is already being discounted into the market,” said Luis Gerardo Limlingan, managing director at Regina Capital Development.

In addition, Limlingan noted that US non-farm payrolls had increased by 235,000 in February with a 9,000 upward revision to the prior two months, moderately above consensus expectations. Meanwhile, he noted that US jobless ratio had edged down to 4.7 percent, one tenth below Fed officials’ estimate.

Read more: http://business.inquirer.net/226080/psei-back-7200-sm-rebounds

Monday, March 6, 2017

Philippine Stocks Watch-list : MAR 2017

Philippine Stocks Watch-list using Warren-buffett stocks filter applied to PSE

To learn the technique of Warren-buffett follow the link below:

Saturday, February 11, 2017

Philippine Stocks Watch-list : FEB 2017

Philippine Stocks Watch-list using Warren-buffett stocks filter applied to PSE

To learn the technique of Warren-buffett follow the link below:

Wednesday, February 8, 2017

COL: It’s the year to buy stocks

This 2017 is an opportune year for investors to accumulate Philippine stocks especially whenever the stock barometer falls below its fair valuation of 7,500, leading online stock brokerage COL Financial said.

In a press briefing on Monday, COL head of research April Lee-Tan said it would be difficult to justify premium valuations at present given “unexciting” earnings prospects from corporate Philippines this year. COL expects average corporate earnings to rise by 6.9 percent this year, slower than previous years.

She also cited numerous risks, including higher inflation and interest rates, the weak peso and President Duterte’s policies that may prove “painful” over the short term, including his tax reform program.

But COL continued to have a favorable long-term view on the Philippine economy and the stock market, Tan said. She said the same policies that may be painful in the short-term would be beneficial in the long term, Tan added.

COL said the government needed to implement tax reforms to raise enough funds to meet its goal of increasing disbursements from around 18.2 percent of the gross domestic product (GDP) in 2016 to around 20.2 percent in 2019.

Read more: https://business.inquirer.net/224147/col-year-buy-stocks

In a press briefing on Monday, COL head of research April Lee-Tan said it would be difficult to justify premium valuations at present given “unexciting” earnings prospects from corporate Philippines this year. COL expects average corporate earnings to rise by 6.9 percent this year, slower than previous years.

She also cited numerous risks, including higher inflation and interest rates, the weak peso and President Duterte’s policies that may prove “painful” over the short term, including his tax reform program.

But COL continued to have a favorable long-term view on the Philippine economy and the stock market, Tan said. She said the same policies that may be painful in the short-term would be beneficial in the long term, Tan added.

COL said the government needed to implement tax reforms to raise enough funds to meet its goal of increasing disbursements from around 18.2 percent of the gross domestic product (GDP) in 2016 to around 20.2 percent in 2019.

Read more: https://business.inquirer.net/224147/col-year-buy-stocks

Wednesday, January 25, 2017

PSE looking at up to 8 IPOs this year

MANILA, Philippines - The Philippine Stock Exchange (PSE), is looking at six to eight initial public offerings (IPOs) this year or possibly double the four IPOs last year, its top official said.

“We’re looking at six to eight IPOs this year. It should be better than last year,” PSE president Hans Sicat said in a recent interview.

Sicat declined to name which companies but noted that some of these IPO candidates already have pending applications with the PSE.

Sicat said the environment is likely better this year as some of the global uncertainties have already dissipated. These include last year’s policy rate setting meeting of the US Federal Reserve, the US elections and move of Britain to exit from the European Union.

Among the IPO bound companies are Xeleb Inc., the celebrity mobile games company of listed technology company Xurpas Inc., media technology company Audiowav and home and construction supplier Wilcon.

Last year, total capital raised from the local bourse including IPOs amounted to P170.12 billion, slightly lower than the P184.60 billion raised for the whole of 2015.

IPOs alone amounted to P29 billion last year from P5 billion in 2015, according to data from the First Metro Investment Corp., the investment banking arm of George Ty-owned Metrobank.

Read more at http://www.philstar.com/business/2017/01/16/1662580/pse-looking-8-ipos-year

“We’re looking at six to eight IPOs this year. It should be better than last year,” PSE president Hans Sicat said in a recent interview.

Sicat declined to name which companies but noted that some of these IPO candidates already have pending applications with the PSE.

Sicat said the environment is likely better this year as some of the global uncertainties have already dissipated. These include last year’s policy rate setting meeting of the US Federal Reserve, the US elections and move of Britain to exit from the European Union.

Among the IPO bound companies are Xeleb Inc., the celebrity mobile games company of listed technology company Xurpas Inc., media technology company Audiowav and home and construction supplier Wilcon.

Last year, total capital raised from the local bourse including IPOs amounted to P170.12 billion, slightly lower than the P184.60 billion raised for the whole of 2015.

IPOs alone amounted to P29 billion last year from P5 billion in 2015, according to data from the First Metro Investment Corp., the investment banking arm of George Ty-owned Metrobank.

Read more at http://www.philstar.com/business/2017/01/16/1662580/pse-looking-8-ipos-year

PSEi rallies ahead of GDP

MANILA, Philippines - The stock market rallied yesterday on expectations of a strong gross domestic product (GDP) growth for 2016.

The benchmark Philippine Stock Exchange Index soared 141.69 points or 1.95 percent to finish at 7,374.35 while the broader All Shares index rose by 60.51 points or 1.38 percent to end at 4,426.14

Most of the sectors likewise closed in positive territory recording huge gains – 2.26 percent for the holding firms index, 1.57 percent for the services gauge and 1.49 percent for the financials index

Total value turnover reached P5.61 billion.

Market breadth was positive as advancing stocks outpaced decliners, 108 to 79 while 45 stocks were left unchanged.

The National Economic and Development Authority (NEDA) is expected to announce the fourth quarter and full year 2016 gross domestic product performance on Jan. 26.

Moody’s Analytics expects the economy to have accelerated to 7.05 percent in 2016 as it is expected to have accelerated 7.2 percent in the final quarter of last year,

Read more at http://www.philstar.com/business/2017/01/24/1664813/psei-rallies-ahead-gdp-report

Monday, January 23, 2017

Philippines stocks higher at close of trade; PSEi Composite up 1.96%

Investing.com – Philippines stocks were higher after the close on Monday, as gains in the Holding Firms, Services and Banking & Financials sectors led shares higher.

At the close in Philippines, the PSEi Composite gained 1.96% to hit a new 1-month high.

The best performers of the session on the PSEi Composite were SM Investments Corp (PS:SM), which rose 5.37% or 36.000 points to trade at 706.000 at the close. Meanwhile, Robinsons Land Corp (PS:RLC) added 4.17% or 1.050 points to end at 26.200 and Globe Telecom Inc (PS:GLO) was up 4.04% or 68.000 points to 1750.000 in late trade.

The worst performers of the session were Alliance Global Group Inc (PS:AGI), which fell 1.25% or 0.160 points to trade at 12.600 at the close. Semirara Mining Corp (PS:SCC) declined 0.14% or 0.2000 points to end at 139.5000 and Megaworld Corp (PS:MEG) was 0.00% or 0.000 points to 3.730.

Rising stocks outnumbered declining ones on the Philippines Stock Exchange by 107 to 79 and 45 ended unchanged.

Gold for February delivery was up 0.69% or 8.35 to $1213.25 a troy ounce. Elsewhere in commodities trading, Crude oil for delivery in March fell 0.64% or 0.34 to hit $52.88 a barrel, while the March Brent oil contract fell 0.47% or 0.26 to trade at $55.23 a barrel.

CNY/PHP was up 0.25% to 7.2775, while USD/PHP fell 0.05% to 49.895.

The US Dollar Index was down 0.44% at 100.33

The Bill Chill plans P600M IPO

Beverage retailer The Big Chill Inc. (TBCI), a subsidiary of publicly-listed Agrinurture Inc. (ANI), plans to debut on the local stock market this year to raise as much as P600 million for an expansion program in Greater China.

Banking on rekindled bilateral ties between China and the Philippines following Pres. Rodrigo Duterte’s visit to Beijing last October, TBCI said in a press statement on Monday that it would raise capital expenditures for such offshore expansion.

Ahead of this equity exercise, the board of TBCI approved the issuance of warrants in favor of qualified shareholders of its parent firm ANI as of record date Feb. 3, 2017.

A warrant gives the holder the right, but not the obligation, to buy or sell a security at a certain price before expiration. The price at which the underlying security can be bought or sold is referred to as the exercise price or strike price.

In this case, a shareholder of ANI owning at least 2,000 shares will have the right to avail of one TBCI warrant at the strike price of P1 or based on TBCI par value, with five-year American call option that will expire on Jan. 19, 2022. The ratio will be one warrant equivalent to one TBCI share.

The proposed initial public offering is expected to range from a low of P500 million to as high as P600 million, a company spokesperson said.

Read more: https://business.inquirer.net/223369/bill-chill-plans-p600m-ipo

Banking on rekindled bilateral ties between China and the Philippines following Pres. Rodrigo Duterte’s visit to Beijing last October, TBCI said in a press statement on Monday that it would raise capital expenditures for such offshore expansion.

Ahead of this equity exercise, the board of TBCI approved the issuance of warrants in favor of qualified shareholders of its parent firm ANI as of record date Feb. 3, 2017.

A warrant gives the holder the right, but not the obligation, to buy or sell a security at a certain price before expiration. The price at which the underlying security can be bought or sold is referred to as the exercise price or strike price.

In this case, a shareholder of ANI owning at least 2,000 shares will have the right to avail of one TBCI warrant at the strike price of P1 or based on TBCI par value, with five-year American call option that will expire on Jan. 19, 2022. The ratio will be one warrant equivalent to one TBCI share.

The proposed initial public offering is expected to range from a low of P500 million to as high as P600 million, a company spokesperson said.

Read more: https://business.inquirer.net/223369/bill-chill-plans-p600m-ipo

Tuesday, January 10, 2017

PSEi now at 7,300 level

The local stock barometer continued its winning streak for the sixth straight session on Tuesday, firming up above the 7,300 mark despite an overnight downturn in Wall Street.

T

he main-share Philippine Stock Exchange index gained 88 points or 1.21 percent to close at 7,364.34 as risk appetite held up across the region despite renewed jitters in the West.

“Risk sentiment took a hit last night with investors getting anxious about the future of the single EU market. Weakening of commodity prices did not help the broad sentiment either,” Citigroup said in a research note.

At the local market, positioning for the year ahead continued to dominate given good prospects for the economy this year.

Read more: https://business.inquirer.net/222765/psei-now-7300-level

T

he main-share Philippine Stock Exchange index gained 88 points or 1.21 percent to close at 7,364.34 as risk appetite held up across the region despite renewed jitters in the West.

“Risk sentiment took a hit last night with investors getting anxious about the future of the single EU market. Weakening of commodity prices did not help the broad sentiment either,” Citigroup said in a research note.

At the local market, positioning for the year ahead continued to dominate given good prospects for the economy this year.

Read more: https://business.inquirer.net/222765/psei-now-7300-level

Saturday, January 7, 2017

Start Learning How to Invest Stocks Today

Philippine Stocks - Virtual Trading

For mobile users you can also try TradeHero

http://ph-uvs.blogspot.com/2016/09/want-to-fast-track-learning-in.html

To register : https://www.stocksph.com/login

For mobile users you can also try TradeHero

http://ph-uvs.blogspot.com/2016/09/want-to-fast-track-learning-in.html

Friday, January 6, 2017

PSE Stocks Watch-list : JAN 2017

Stocks Watch-list using Warren-buffett stocks filter applied to PSE

To learn the technique of Warren-buffett follow the link below:

Philippines stocks higher at close of trade; PSEi Composite up 0.54%

Investing.com – Philippines stocks were higher after the close on Friday, as gains in the Services, Property and Holding Firms sectors led shares higher.

At the close in Philippines, the PSEi Composite added 0.54% to hit a new 1-month high.

The best performers of the session on the PSEi Composite were Globe Telecom Inc (PS:GLO), which rose 6.25% or 99.000 points to trade at 1684.000 at the close. Meanwhile, Aboitiz Equity Ventures Inc (PS:AEV) added 3.17% or 2.300 points to end at 74.800 and International Container Terminal Services Inc (PS:ICT) was up 2.92% or 2.100 points to 73.900 in late trade.

The worst performers of the session were Petron Corp (PS:PCOR), which fell 5.34% or 0.550 points to trade at 9.750 at the close. DMCI Holdings Inc (PS:DMC) declined 2.67% or 0.360 points to end at 13.100 and GT Capital Holdings Inc (PS:GTCAP) was down 0.96% or 13.000 points to 1337.000.

Falling stocks outnumbered advancing ones on the Philippines Stock Exchange by 101 to 98 and 37 ended unchanged.

Gold for February delivery was down 0.40% or 4.75 to $1176.55 a troy ounce. Elsewhere in commodities trading, Crude oil for delivery in February rose 0.02% or 0.01 to hit $53.77 a barrel, while the March Brent oil contract rose 0.02% or 0.01 to trade at $56.90 a barrel.

CNY/PHP was down 0.37% to 7.1526, while USD/PHP rose 0.14% to 49.525.

The US Dollar Index was up 0.25% at 101.64.

Source : Investing.com

Tuesday, January 3, 2017

PSEi up on 2017’s first trading day

The local stock barometer closed higher in thin trading on the first working day of 2017, as upbeat China factory gauge brought good tidings to regional markets.

The Philippine Stock Exchange index gained 20.67 points or 0.30 percent to 6,861.31 on the first trading day of the year.

For the third straight session, foreign investors were in a net buying position on upbeat prospects for the new year. Net foreign inflows to the local stock market stood at P319 million for the day.

Value turnover for the day was meager at P2.68 billion as many investors were still on a holiday break after the New Year turnover.

“The year ahead could once again be challenging. However, I believe that challenges offer us opportunities. Challenges hone our skills, develop our character, and allow us to appreciate the things we have,” PSE chair Jose Pardo said in his welcome remarks during the bell ringing program on Tuesday.

The Philippine Stock Exchange index gained 20.67 points or 0.30 percent to 6,861.31 on the first trading day of the year.

For the third straight session, foreign investors were in a net buying position on upbeat prospects for the new year. Net foreign inflows to the local stock market stood at P319 million for the day.

Value turnover for the day was meager at P2.68 billion as many investors were still on a holiday break after the New Year turnover.

“The year ahead could once again be challenging. However, I believe that challenges offer us opportunities. Challenges hone our skills, develop our character, and allow us to appreciate the things we have,” PSE chair Jose Pardo said in his welcome remarks during the bell ringing program on Tuesday.

Subscribe to:

Comments (Atom)