Philippine Stocks - Buy Signal

RCB is currently bullish and it's good to buy at this level, resistance will be on R1 at P58.72. you can also set a price alert for R1 to remind you when to sell.

For BPI traders here's the steps on how to set the price alerts.

http://ph-uvs.blogspot.com/2016/09/how-to-set-price-alerts-on-bpi-trade.html

Rizal Commercial Banking Corporation provides commercial banking services. The Bank offers foreign exchange, trust, depositary, loans, financing and fund transfer services to its customers.

If you still don't have a trading account here are the links on how to get one.

Opening your first BPI Trade Account

http://ph-uvs.blogspot.com/2016/09/opening-your-first-bpi-trade-account.html

Opening your first account with Col Financial

http://ph-uvs.blogspot.com/2016/09/open-your-first-account-with-col.html

Opening your first trading account with BDO Nomura

http://ph-uvs.blogspot.com/2016/09/opening-your-first-trading-account-with.html

Other online PSE Stock broker in the Philippines

http://ph-uvs.blogspot.com/2016/09/top-20-pse-online-stock-broker-in.html

Friday, September 30, 2016

Tuesday, September 27, 2016

Philippine Stocks - Warren Buffett Stock 101

Here's a good video to learn stock basic "Warren Buffett Stock 101:

Using the technique from Warren Buffet Stock 101 to filter stocks in the Philippines.

Using the technique from Warren Buffet Stock 101 to filter stocks in the Philippines.

To learn more about stock screener click the url below:

Friday, September 23, 2016

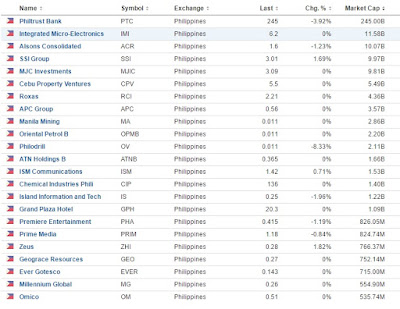

Philippine Stocks Watchlist

Here are the list of undervalued stocks in the Philippines based on the technical indicators they are all oversold and this is a great opportunity to buy to maximize profit.

Technical indicators used ( Stoch, RSI, CCI )

Thursday, September 22, 2016

PSEi Index :: Ready to test the 8,100 points

PSEi Index :: PCOMP:IND is now ready to test the 8,100 points as the Market is currently bullish and already hit the support level S1 at 7,500 points, the market will pullback and try to break the resistance at 8,000 points R1.

The Philippine Stock Exchange PSEi Index is a capitalization-weighted index composed of stocks representative of the Industrial, Properties, Services, Holding Firms, Financial and Mining & Oil Sectors of the PSE. The index has a base value of 1022.045 as of February 28, 1990. Free-float adjusted as of 4/3/06 *New industry classification effective 1/2/2006. Formerly named PSE Composite.

The Philippine Stock Exchange PSEi Index is a capitalization-weighted index composed of stocks representative of the Industrial, Properties, Services, Holding Firms, Financial and Mining & Oil Sectors of the PSE. The index has a base value of 1022.045 as of February 28, 1990. Free-float adjusted as of 4/3/06 *New industry classification effective 1/2/2006. Formerly named PSE Composite.

Wednesday, September 21, 2016

Philippine Stocks - COL's Easy Investment Program (EIP)

The COL EIP is an easy and simple way to start investing in the stock market. For as low as Php 5,000, you can start building your personal wealth while minimizing your risk and maximizing your returns through the time-tested strategy of peso-cost-averaging.

Find out how investing small amounts on a regular basis can substantially increase your profit over time. The COL EIP makes stock investing even more convenient with features such as the auto-calendar and auto-reminder tools to allow you to set-up your investing schedule. Learn more about our COL EIP by viewing our orientation video below:

(Source:: https://www.colfinancial.com)

COL's Easy Investment Program (EIP)

COL's EIP in Action

COL's Premium Growth Stocks

Creating an EIP Schedule

Reviewing your EIP Schedule

How to Modify your EIP Schedule

How to Buy your EIP Shares (Manual Mode)

How to Buy your EIP Shares (Auto Mode)

Managing your EIP Investments

Subscribe to:

Posts (Atom)