Monday, May 22, 2017

Trade and earn in the Philippine stocks market using this App

Tsupetot - from the word tsup (means kiss or love) and petot (means peso or earn). Love and Earn (nagmahal at kumita in tagalog). Tsupetot is the app that will help you love to trade and earn in the Philippine stocks market.

Whether you are a local from Philippine or a foreign investor, this is the tool for you to easily view real-time Philippine stocks latest market values and historical charts with standard indicators like MACD, RSI, MFI, SMA20 and EMA13.

List of Features include:

1. Sortable Page by %Change, Volume, and Price

2. Last 3 candle view

3. View all stocks chart profile in single page

4. Market Status

5. Stocks Historical Data with indicator

6. PSEi and Sectors Historical Data with indicator

7. Create Porfolio

8. Create Cheatlist/Watchlist

Download now @ Google Play

https://play.google.com/store/apps/details?id=com.flankzone.Tsupetot&hl=en

Download now @ iTunes

https://itunes.apple.com/ph/app/tsupetot/id1161242831?mt=8

Monday, May 15, 2017

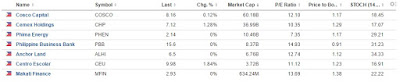

Philippine Stocks Watch-list : MAY 2017

Philippine Stocks Watch-list using Warren-buffett stocks filter applied to PSE

To learn the technique of Warren-buffett follow the link below:

Monday, April 10, 2017

Philippine Stocks Watch-list : APR 2017

Philippine Stocks Watch-list using Warren-buffett stocks filter applied to PSE

To learn the technique of Warren-buffett follow the link below:

Friday, March 24, 2017

Pure Energy’s P1.6B IPO ok’d

The Securities and Exchange Commission (SEC) has approved a plan by Pure Energy Holdings Corp. to raise as much as P1.6 billion from an initial public offering.

Pure Energy plans to sell 930 million primary shares at a maximum price of P1.62 per share. Some 46.5 million in secondary shares have been earmarked as overallotment option.

The offering will bring to public hands up to 15.6 percent of its total shares post-IPO.

Bulk of the proceeds will be used by Pure Energy as capital for hydropower projects. The rest will be used for joint venture projects as well as operating and working capital.

Pure Energy is led by Dexter Tiu, its chair and chief executive officer. Tiu is also a director and treasurer of Coal Asia Holdings.

The company was incorporated in 2013 as a holding firm. Its three subsidiaries are REDC, Pure Water and Pure Geothermal.

REDC is into renewable energy while Pure Water has interests in bulk water, distribution utility and underwater treatment service provider.

REDC won the bidding for a geothermal concession area called Southern Leyte Geothermal Project, located at the south of the renowned Tongonan Geothermal Field. Initial feasibility study conducted by Japan External Trade Organization had estimated an available capacity of 110 megawatts.

Read more: http://business.inquirer.net/226712/pure-energys-p1-6b-ipo-okd

Pure Energy plans to sell 930 million primary shares at a maximum price of P1.62 per share. Some 46.5 million in secondary shares have been earmarked as overallotment option.

The offering will bring to public hands up to 15.6 percent of its total shares post-IPO.

Bulk of the proceeds will be used by Pure Energy as capital for hydropower projects. The rest will be used for joint venture projects as well as operating and working capital.

Pure Energy is led by Dexter Tiu, its chair and chief executive officer. Tiu is also a director and treasurer of Coal Asia Holdings.

The company was incorporated in 2013 as a holding firm. Its three subsidiaries are REDC, Pure Water and Pure Geothermal.

REDC is into renewable energy while Pure Water has interests in bulk water, distribution utility and underwater treatment service provider.

REDC won the bidding for a geothermal concession area called Southern Leyte Geothermal Project, located at the south of the renowned Tongonan Geothermal Field. Initial feasibility study conducted by Japan External Trade Organization had estimated an available capacity of 110 megawatts.

Read more: http://business.inquirer.net/226712/pure-energys-p1-6b-ipo-okd

Sunday, March 19, 2017

PSEi soars past 7,300 as US Fed jitters fizzle out

The stock barometer surged to the 7,300 level on Friday as the US Federal Reserve’s less hawkish stance boosted risk-taking appetite.

Rising for the second straight session on Friday, the Philippine Stock Exchange index (PSEi) gained 66.42 points or 0.91 percent to close at 7,345.02. The local index outperformed regional markets.

For the week, the PSEi racked up 198.75 points or 2.8 percent.

“Risk-love is in euphoria, expectations elevated, and economic surprises at peak,” investment house BofA Merrill Lynch said in a research note.

While the US Federal Reserve recently hiked interest rates by 25 basis points, its subsequent statements quashed earlier fears of a faster pace of tightening moving forward.

On Friday, the day’s gains were led by the cyclical financial and property counters, which both advanced by over

1 percent.

Only the industrial counter ended lower.

Value turnover for the day amounted to nearly P14 billion. Foreign investors were in a net buying position amounting to P169 million.

There were 103 advancers that beat 78 decliners, while 58 stocks were unchanged.

JG Summit led the PSEi higher with its 4.18 percent gain, while BPI and RLC both added over 3 percent.

EDC gained over 2 percent while ALI, BDO, SM Investments and ICTSI all rose by over 1 percent.

SM Prime, Ayala Corp., PLDT and Security Bank all firmed up.

Meanwhile, Metro Pacific, URC and AEV all tumbled by over 2 percent.

DMCI, GT Capital and Jollibee all slipped by over 1 percent.

Cemex continued to slide yesterday by 3.23 percent.

Read more: http://business.inquirer.net/226332/psei-soars-past-7300-us-fed-jitters-fizzle

Subscribe to:

Posts (Atom)