Wednesday, November 22, 2017

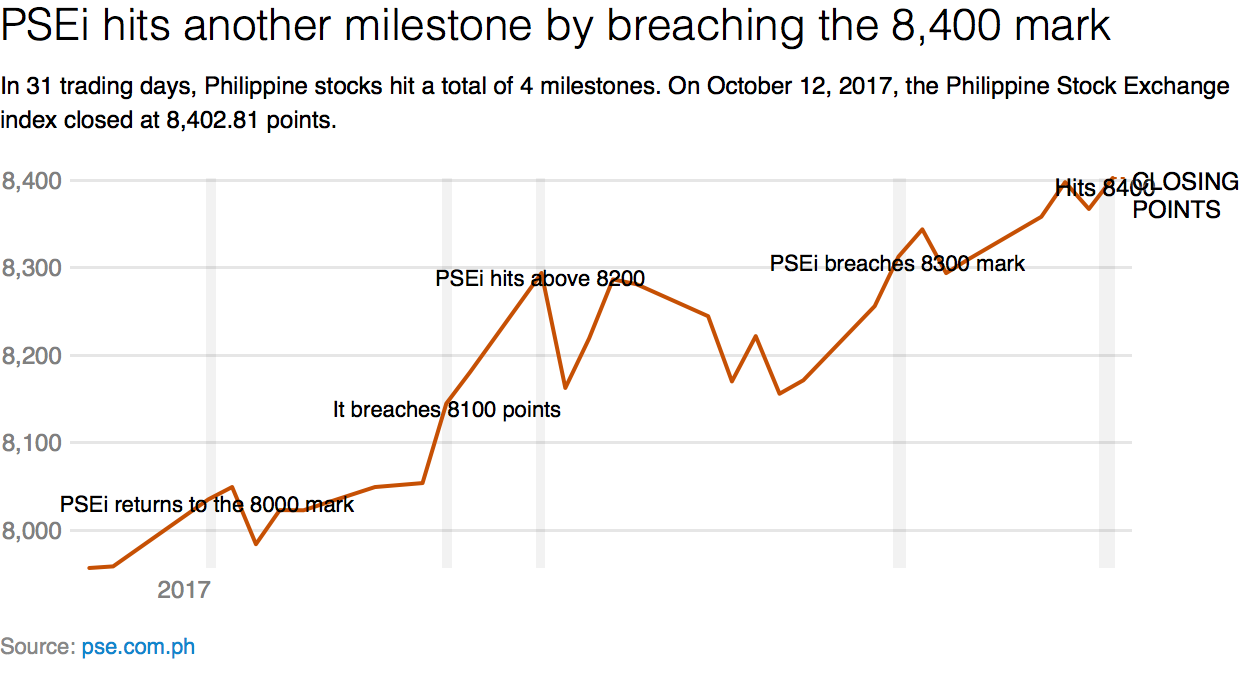

Philippine stocks close above 8,400 in new milestone

MANILA, Philippines – Philippine stocks continued their rally, breaching the 8,400 mark on Thursday, October 12, as investors took their cue from sentiments overseas.

At the close of Thursday's trading, the Philippine Stock Exchange index (PSEi) surged by 0.53% to 8,402.81 points. Meanwhile, the broader All Shares index rose by 20.40 points or 0.42% to 4,928.28 at the closing bell.

This is the PSEi's 4th milestone in 31 trading days.

On the same day, Bloomberg reported that Asian equities advanced after US stocks hit record highs.

Bloomberg also reported that minutes from the US Federal Open Market Committee (FOMC) meeting in September show that a December interest rate hike is likely.

"Philippine markets resumed the upward trajectory as the minutes from the FOMC meeting cofirmed what was on many analysts' minds," Marita Limlingan, president of Regina Capital Development Corporation, said in a note. (READ: New milestone as Philippine stocks breach 8,300 mark)

"The minutes from the September FOMC meeting discussed near-term effects from hurricanes Harvey, Irma, and Maria; but suggested broadly unchanged views on the underlying pace of growth and inflation," she added.

On the local front, the Philippine market is zeroing in on the developments in the proposed Tax Reform for Acceleration and Inclusion (TRAIN) bill.

President Rodrigo Duterte's economic managers said they are trying to convince the Senate to make its version of tax reform "closer" to that of the House of Representatives, to get enough financial muscle needed to implement the country's ambitious infrastructure program.

Socioeconomic Planning Secretary Ernesto Pernia had said he is optimistic that implementation of the tax reform package can begin by January 2018. (READ: EXPLAINER: Senate, House versions of the tax reform bill)

Read more: https://www.rappler.com/business/185090-philippine-stock-exchange-index-close-above-8400

Tuesday, November 14, 2017

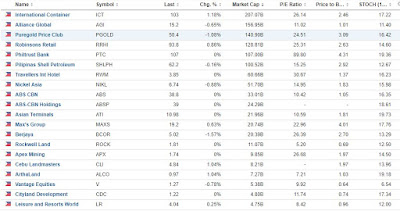

Philippine Stocks Watch-list : NOV 2017

Philippine Stocks Watch-list that are currently undervalued for the month of November:

To learn the technique of Warren-buffett follow the link below:

Thursday, October 26, 2017

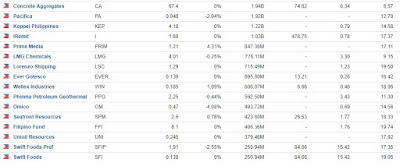

Philippine Stocks Watch-list : OCT 2017

Philippine Stocks Watch-list that are currently undervalued for the month of October:

To learn the technique of Warren-buffett follow the link below:

Wednesday, September 27, 2017

The Secret Behind a Property Company's 2,500% Stock Surge

It’s been a fast ascent for college dropout Edgar “Injap” Sia, who less than a decade ago was selling barbecue chicken in the Philippines. He now leads the real estate developer with the best stock gains in Asia.

His company, DoubleDragon Properties Corp., went public in the Philippines in 2014 and has surged 2,500 percent since it began trading in April that year through Jan. 31, beating 460 other Asian developers worth at least $500 million. That surge has inflated DoubleDragon’s market value to 115.1 billion pesos ($2.3 billion), propelling it to the nation’s top five developers even though it owns and manages a fraction of the real estate held by its rivals.

Sia was studying architecture when he dropped out at 19 to start a business venture with classmates. Now 40, Sia ranks among the youngest tycoons in the Philippines. In 2003, he started a chicken shop in Iloilo City before turning it into a nationwide chain that overtook McDonald’s Corp. in store count in 2010. That year, he sold his Mang Inasal chicken chain to Jollibee Foods Corp., and later partnered with its founder Tony Tan Caktiong and with SM Investments Corp., owner of the nation’s largest retailer, to venture into property and malls.

With the same lofty ambitions he used to expand his chicken empire, Sia aims to operate 100 CityMall outlets by 2020 to help meet the basic needs of shoppers in smaller provinces. DoubleDragon is a minnow among Asian developers -- it had $844.5 million of assets in the third quarter of 2016, about 0.6 percent of the assets of Asia’s largest real estate company, China Evergrande Group.

“The stock has outperformed because many investors believe in its business model, which is geared towards addressing geographical gaps in retail,” said Cristina Ulang, head of research at Manila-based First Metro Investment Corp. “DoubleDragon is very focused on penetrating smaller cities that are growth areas of the future. It’s already positioned ahead of the others when growth filters into these smaller cities. ”

Since DoubleDragon’s 2014 initial public offering, the only developers worldwide to beat its gain have been a Venezuelan real estate investment trust and a U.S.-listed Chinese provider of real estate services. The stock surge inflated DoubleDragon’s market value to a record in June that then made it the third-most valuable Philippine builder, dislodging Megaworld Corp., the largest landlord for call centers. While DoubleDragon shares are down 26 percent from their all-time high, the stock may rebound to a new record if the company delivers on mall roll-out and earnings growth pledges, Ulang said.

The stock rose as much as 5.6 percent to a three-month high, outpacing a 0.2 percent gain in the benchmark Philippine Stock Exchange Index.

Monday, September 25, 2017

Philippine Stocks Watch-list : SEPT 2017 : SALE!!!

Philippine Stocks Watch-list that are currently on SALE for the month of September:

To learn the technique of Warren-buffett follow the link below:

Subscribe to:

Posts (Atom)