The Securities and Exchange Commission (SEC) has approved a plan by Pure Energy Holdings Corp. to raise as much as P1.6 billion from an initial public offering.

Pure Energy plans to sell 930 million primary shares at a maximum price of P1.62 per share. Some 46.5 million in secondary shares have been earmarked as overallotment option.

The offering will bring to public hands up to 15.6 percent of its total shares post-IPO.

Bulk of the proceeds will be used by Pure Energy as capital for hydropower projects. The rest will be used for joint venture projects as well as operating and working capital.

Pure Energy is led by Dexter Tiu, its chair and chief executive officer. Tiu is also a director and treasurer of Coal Asia Holdings.

The company was incorporated in 2013 as a holding firm. Its three subsidiaries are REDC, Pure Water and Pure Geothermal.

REDC is into renewable energy while Pure Water has interests in bulk water, distribution utility and underwater treatment service provider.

REDC won the bidding for a geothermal concession area called Southern Leyte Geothermal Project, located at the south of the renowned Tongonan Geothermal Field. Initial feasibility study conducted by Japan External Trade Organization had estimated an available capacity of 110 megawatts.

Read more: http://business.inquirer.net/226712/pure-energys-p1-6b-ipo-okd

Friday, March 24, 2017

Sunday, March 19, 2017

PSEi soars past 7,300 as US Fed jitters fizzle out

The stock barometer surged to the 7,300 level on Friday as the US Federal Reserve’s less hawkish stance boosted risk-taking appetite.

Rising for the second straight session on Friday, the Philippine Stock Exchange index (PSEi) gained 66.42 points or 0.91 percent to close at 7,345.02. The local index outperformed regional markets.

For the week, the PSEi racked up 198.75 points or 2.8 percent.

“Risk-love is in euphoria, expectations elevated, and economic surprises at peak,” investment house BofA Merrill Lynch said in a research note.

While the US Federal Reserve recently hiked interest rates by 25 basis points, its subsequent statements quashed earlier fears of a faster pace of tightening moving forward.

On Friday, the day’s gains were led by the cyclical financial and property counters, which both advanced by over

1 percent.

Only the industrial counter ended lower.

Value turnover for the day amounted to nearly P14 billion. Foreign investors were in a net buying position amounting to P169 million.

There were 103 advancers that beat 78 decliners, while 58 stocks were unchanged.

JG Summit led the PSEi higher with its 4.18 percent gain, while BPI and RLC both added over 3 percent.

EDC gained over 2 percent while ALI, BDO, SM Investments and ICTSI all rose by over 1 percent.

SM Prime, Ayala Corp., PLDT and Security Bank all firmed up.

Meanwhile, Metro Pacific, URC and AEV all tumbled by over 2 percent.

DMCI, GT Capital and Jollibee all slipped by over 1 percent.

Cemex continued to slide yesterday by 3.23 percent.

Read more: http://business.inquirer.net/226332/psei-soars-past-7300-us-fed-jitters-fizzle

Wilcon to raise P7B in Philippines’ 1st IPO this year

WILCON Depot, Inc. is raising P7 billion in the first initial public offering (IPO) this year after pricing the deal at the low end of its target range.

In a statement released on Friday, First Metro Investment Corp. (FMIC) Executive Vice-President Justino Juan R. Ocampo said the IPO price of the home improvement and construction supplies retailer was set at P5.05 per share, giving the company a market capitalization of more than P20 billion after listing.

“We convinced Mr. Belo to price at lower end to ensure discount to comparables and give upside to investors,” BDO Capital & Investment Corp. President Eduardo V. Francisco said in a separate mobile phone message, referring to Wilcon Chairman William T. Belo.

Wilson had earlier set a price range of P5-P5.68 apiece.

The offering was more than three times oversubscribed on the back of strong demand from “quality” institutional investors and offshore investors attracted to the strong prospects of the country’s construction and housing industry, FMIC said.

“The success of Wilcon’s IPO demonstrates the investment community’s continued confidence in the Philippine retail market. As disposable income of Filipinos increases, a lot more people are now buying houses or improving their existing homes,” Mr. Belo said in the same statement.

Proceeds from the IPO will be used to bankroll store network expansion, debt retirement and general corporate purposes, according to Wilcon’s prospectus.

Since opening its first store in 1977, Wilcon has transformed itself into a one-stop shop for construction supply and home improvement. It has 37 depots and small format stores across the country, 17 of which are in Metro Manila, 16 more in Luzon, 2 in Visayas, and 2 in Mindanao, with over 2,000 employees.

Wilcon is banking on the continued expansion of its store network to sustain double-digit growth in sales and earnings. In the first nine months of 2016, it booked a 10% year-on-year increase in net sales to P11.73 billion and netted 50% more or P483 million.

Wilcon kicks off the domestic tranche of the maiden share sale on March 20, with its debut on the Main Board of the Philippine Stock Exchange slated on March 31. The equity offer is selling 34% of its outstanding capital to the public.

FMIC was tapped as the issue manager and bookrunner, with BDO Capital also acting as joint lead underwriter for the IPO. RCBC Capital Corp. and Penta Capital Investment Corp. were mandated as co-lead underwriter and participating underwriter.

Read more: http://www.bworldonline.com/content.php?section=TopStory&title=wilcon-to-raise-p7b-in-philippines-1supstsup-ipo-this-year&id=142376

“We convinced Mr. Belo to price at lower end to ensure discount to comparables and give upside to investors,” BDO Capital & Investment Corp. President Eduardo V. Francisco said in a separate mobile phone message, referring to Wilcon Chairman William T. Belo.

Wilson had earlier set a price range of P5-P5.68 apiece.

The offering was more than three times oversubscribed on the back of strong demand from “quality” institutional investors and offshore investors attracted to the strong prospects of the country’s construction and housing industry, FMIC said.

“The success of Wilcon’s IPO demonstrates the investment community’s continued confidence in the Philippine retail market. As disposable income of Filipinos increases, a lot more people are now buying houses or improving their existing homes,” Mr. Belo said in the same statement.

Proceeds from the IPO will be used to bankroll store network expansion, debt retirement and general corporate purposes, according to Wilcon’s prospectus.

Since opening its first store in 1977, Wilcon has transformed itself into a one-stop shop for construction supply and home improvement. It has 37 depots and small format stores across the country, 17 of which are in Metro Manila, 16 more in Luzon, 2 in Visayas, and 2 in Mindanao, with over 2,000 employees.

Wilcon is banking on the continued expansion of its store network to sustain double-digit growth in sales and earnings. In the first nine months of 2016, it booked a 10% year-on-year increase in net sales to P11.73 billion and netted 50% more or P483 million.

Wilcon kicks off the domestic tranche of the maiden share sale on March 20, with its debut on the Main Board of the Philippine Stock Exchange slated on March 31. The equity offer is selling 34% of its outstanding capital to the public.

FMIC was tapped as the issue manager and bookrunner, with BDO Capital also acting as joint lead underwriter for the IPO. RCBC Capital Corp. and Penta Capital Investment Corp. were mandated as co-lead underwriter and participating underwriter.

Read more: http://www.bworldonline.com/content.php?section=TopStory&title=wilcon-to-raise-p7b-in-philippines-1supstsup-ipo-this-year&id=142376

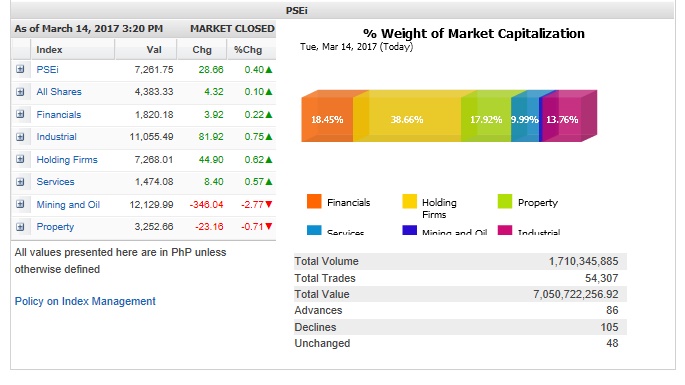

Tuesday, March 14, 2017

PSEi holds fort ahead of influential Fed Meeting

The stock barometer continued to climb on Tuesday on selective buying of large cap stocks ahead of a much-awaited US Federal Reserve meeting.

The main-share Philippine Stock Exchange index (PSEi) added 28.66 points or 0.4 percent to close at 7,261.75, rising for the second session.

ADVERTISEMENT

“With no economic data Monday, investors were instead focusing on the two-day Federal Open Market Committee meeting that kicks off Tuesday,” said Luis Gerardo Limlingan, managing director at Regina Capital Development.

Limlingan noted that overnight, US stocks had closed marginally higher after switching between small gains and losses on Monday as investors refrained from making sizeable bets ahead of a Federal Reserve meeting that was widely expected to deliver an interest rate increase.

At the local market, the day’s gains were led by the financial, industrial, holding firm and services counters.

On the other hand, the mining/oil counter was down by 2.77 percent amid the challenging regulatory environment brought about by the government’s antimining bias.

Despite the PSEi’s slight gain, market breadth was negative. There were 105 decliners against 86 advancers, while 48 stocks were unchanged.

The PSEi was led higher by ICTSI, which surged by 5.04 percent and was the day’s most actively traded stock. ICTSI announced on Tuesday the opening of Puerto Aguadulce, a joint venture terminal in Port of Buenaventura, Colombia. The first phase of the $550-million world class multi-use container and bulk handling facility can handle mega container vessels with capacities of up to 18,000 TEUs (twenty-foot equivalent units).

On Monday, ICTSI also reported a 207-percent surge in net income to $180 million.

Read more: http://business.inquirer.net/226146/psei-holds-fort-ahead-influential-fed-meeting

Monday, March 13, 2017

PSEi back to 7,200 as SM rebounds

The local stock barometer climbed back to the 7,200 level on Monday as leading conglomerate SM Investments recouped most losses from Friday’s sell-off.

The main-share Philippine Stock Exchange index (PSEi) gained 86.82 points or 1.21 percent to close at 7,233.09 on the first day of the PSEi’s rebalancing.

All counters went up, led by holding firms, which firmed up by 1.9 percent due to SM’s rebound.

SM bounced by 7.76 percent to close at P645.50. To recall, SM slid by 9.24 percent last Friday as fund managers scrambled to realign their portfolios ahead of today’s main index rebalancing.

Effective today (Monday, March 13), SM’s weight (in PSEi) was reduced by 0.51 percent along with the removal of Emperador to accommodate the inclusion of Puregold with a 1-percent weight in the index. Ron Acoba, chief investment strategist at equities research provider Trading Edge, explained that the sharp drop seen on Friday was because index funds that track the PSEi appeared to be worth more than P100 billion which sold 0.5 percent of their SM shares at Friday’s closing.

When asked whether SM had bought back shares from the open market on Monday, SM investor relations chief Cora Guidote said the rebound by driven by bargain-hunting. “A lot of investors had been waiting for a buying window. Since the drop in shares last week was purely technical, investors took advantage,” Guidote said.

Apart from SM’s rebound, the upswing in the local market also reflected mostly firmer regional markets.

“After much market drama, another rate increase from the FOMC (Federal Open Market Committee) now looks like a forgone conclusion when the committee members meet later this week. This information is already being discounted into the market,” said Luis Gerardo Limlingan, managing director at Regina Capital Development.

In addition, Limlingan noted that US non-farm payrolls had increased by 235,000 in February with a 9,000 upward revision to the prior two months, moderately above consensus expectations. Meanwhile, he noted that US jobless ratio had edged down to 4.7 percent, one tenth below Fed officials’ estimate.

Read more: http://business.inquirer.net/226080/psei-back-7200-sm-rebounds

The main-share Philippine Stock Exchange index (PSEi) gained 86.82 points or 1.21 percent to close at 7,233.09 on the first day of the PSEi’s rebalancing.

All counters went up, led by holding firms, which firmed up by 1.9 percent due to SM’s rebound.

SM bounced by 7.76 percent to close at P645.50. To recall, SM slid by 9.24 percent last Friday as fund managers scrambled to realign their portfolios ahead of today’s main index rebalancing.

Effective today (Monday, March 13), SM’s weight (in PSEi) was reduced by 0.51 percent along with the removal of Emperador to accommodate the inclusion of Puregold with a 1-percent weight in the index. Ron Acoba, chief investment strategist at equities research provider Trading Edge, explained that the sharp drop seen on Friday was because index funds that track the PSEi appeared to be worth more than P100 billion which sold 0.5 percent of their SM shares at Friday’s closing.

When asked whether SM had bought back shares from the open market on Monday, SM investor relations chief Cora Guidote said the rebound by driven by bargain-hunting. “A lot of investors had been waiting for a buying window. Since the drop in shares last week was purely technical, investors took advantage,” Guidote said.

Apart from SM’s rebound, the upswing in the local market also reflected mostly firmer regional markets.

“After much market drama, another rate increase from the FOMC (Federal Open Market Committee) now looks like a forgone conclusion when the committee members meet later this week. This information is already being discounted into the market,” said Luis Gerardo Limlingan, managing director at Regina Capital Development.

In addition, Limlingan noted that US non-farm payrolls had increased by 235,000 in February with a 9,000 upward revision to the prior two months, moderately above consensus expectations. Meanwhile, he noted that US jobless ratio had edged down to 4.7 percent, one tenth below Fed officials’ estimate.

Read more: http://business.inquirer.net/226080/psei-back-7200-sm-rebounds

Monday, March 6, 2017

Philippine Stocks Watch-list : MAR 2017

Philippine Stocks Watch-list using Warren-buffett stocks filter applied to PSE

To learn the technique of Warren-buffett follow the link below:

Subscribe to:

Posts (Atom)